✍🏻 A guest post by Philip Totaro, Founder & CEO, IntelStor LLC

It wasn’t quite a Hollywood blockbuster ending for the wind energy auctions held by BOEM for the offshore wind lease areas in California earlier this week, but the results have left many feeling cautiously optimistic about the future of floating offshore wind in the US.

The winners, RWE, Copenhagen Infrastructure Partners (CIP), Ocean Winds along with investment from the Canadian Pension Plan Investment Board (CPPIB), Equinor and Invenergy, demonstrate why experience in Europe, along with Invenergy’s auction win earlier in 2022 for the New York Bight, are important to securing the lease rights. These companies are best positioned to move these floating offshore wind in the US forward amongst the pool of bidders who were registered. However, some commercial and technical challenges may preclude any project build-out and commissioning prior to 2030.

The Bad: Floating wind project finances, technical issues present challenges

Most of the 43 companies who registered to participate in the auction failed to place a bid because they were simply not well capitalized enough to join in the bidding. Also noteworthy by their absence from the winners list were Shell as well as the TotalEnergies / Castle Wind joint venture. Not only were both quite keen on this auction, but they were two of the entities who were exploring floating offshore wind in the US, and specifically the California coast, for offshore wind projects for 10 – 15 years prior to this BOEM auction, and long before most of the lease winners were even contemplating any investment.

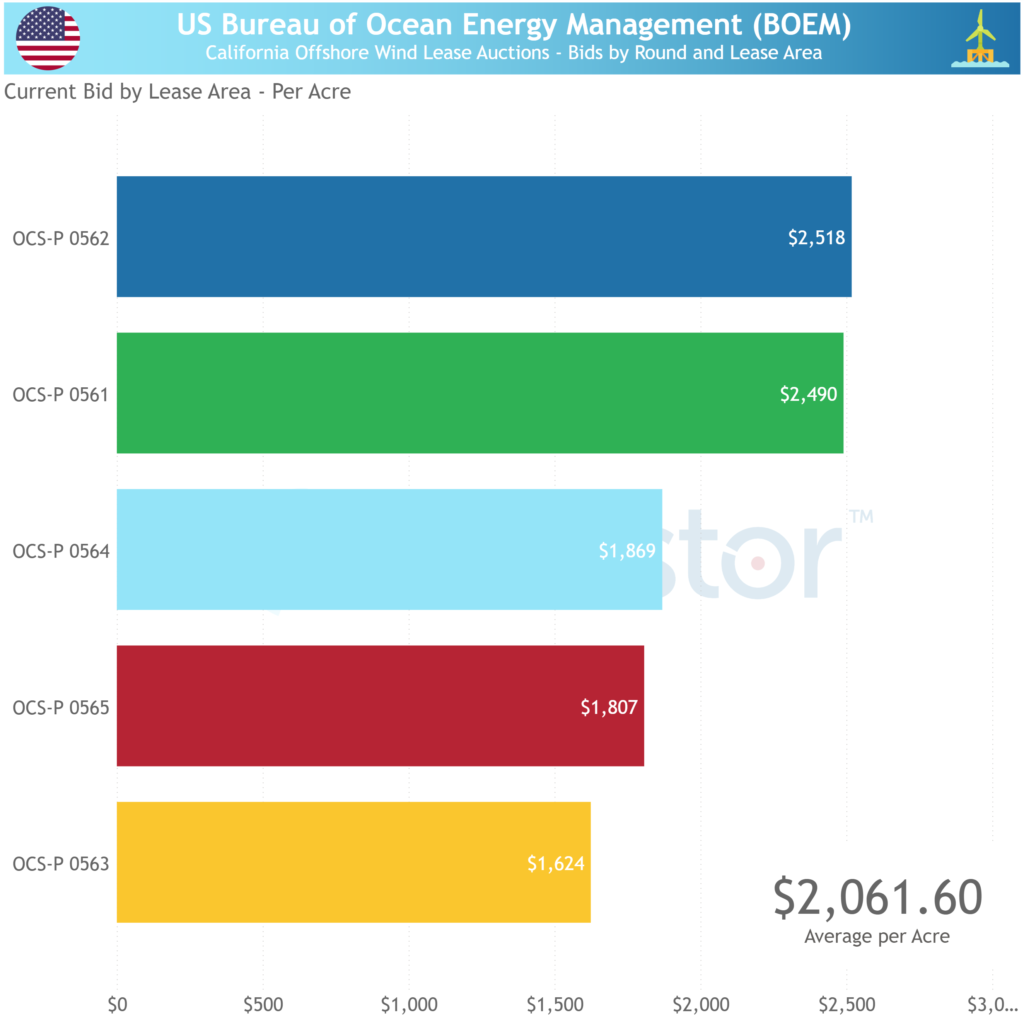

While the prices per acre were lower than the New York Bight and Carolina Long Bay auctions earlier this year, it is not entirely a fair comparison to expect that the prices would be the same, or even higher than the East Coast project sites simply because these were deepwater floating projects. Power purchase contract prices, ease of power offtake concessions, consistency of the average wind speeds, as well as other technical and commercial factors can contribute to the prices paid for a lease area.

In fact, the reasons for the somewhat restrained prices in California’s foray into floating wind were actually due to some of the technical and commercial risks associated with a deepwater floating offshore project site, particularly ones in Humboldt and Morro Bay. All five lease areas currently lack any firm commitment on power offtake, and some sites did not even have one full year of wind resource characterization from floating LIDAR buoys. This led to some more conservative bidding than what was expected by many analysts as well as the US Federal Government.

As for some of the technical concerns, while the deepwater tether technology has been used in O&G, and tested in floating wind offshore demo sites in Europe, this technology has not yet been trialed on projects like those in California with water depths of 550 – 1155 meters amongst the five lease areas.

Additionally, the California Independent System Operator (CAISO) has not yet established some ground rules for interconnection and cost allocation on transmission, which was also a factor in some of the bidders’ hesitancy.

One must also consider the expected power purchase contract prices which each of the leaseholders may expect to receive for these sites. A lack of transparency on power offtake and contract pricing would make any lease bidder want to look towards the lower end of their bid range.

The Good: Floating Wind OEMs, supply chain poised to grow

The total of $757.1 million is nothing to be ashamed of, and these lease prices were still at historical highs for any floating offshore wind tender globally. Prices in California outpaced the cost per acre of any other previously held tender in the UK, China, Japan, Taiwan or South Korea for commercial-scale floating offshore wind project sites.

In other words, there’s plenty of room for optimism.

Unlike the US East Coast, foundation fabricators, OEMs and other wind energy supply chain companies have not already made large capital commitments to lease or buy port space in order to establish factories and quayside assembly sites. Commitments for investment in fabrication facilities or service stations on Staten Island in New York or in Salem, Massachusetts were known in advance of East Coast auctions, providing confidence to East Coast lease bidders that a robust supply chain would be there to meet their requirements.

As for California, while Crowley was recently awarded the contract to develop the necessary infrastructure for the Port of Humboldt Bay, similar commitments for tax credits or public investment from Governor Gavin Newsom’s State Government, or the California Energy Commission (CEC), are yet to be forthcoming for any other port upgrades and infrastructure investments. This will be necessary to unlock private investments in fabrication capacity, assembly facilities, or service sites.

Ports, floating wind foundation fabrication facilities, turbine OEM component manufacturing and ancillary supply chain activities to support floating wind in the Morro Bay project sites is still hypothetical at this stage. With lack of capacity in the Port of Los Angeles, as well as Long Beach, that may only leave San Diego to provide an adequate space to serve any future project sites in the Southern California region, while the Port of Humboldt Bay may serve projects in Northern California as well as Oregon. Nevertheless, Americans are famous for relentless optimism, so in that spirit, the wind energy industry and relevant government bodies are expected to pull together to see these challenges overcome.

The bottom line: Floating offshore wind in the US may not have had all the pomp of a Hollywood premier, but the word is out that the industry is ready to expand, and this should start the process to see the capital flow.

Thanks to Philip Totaro, IntelStor Founder and CEO, for this post and original IntelStor graphic.